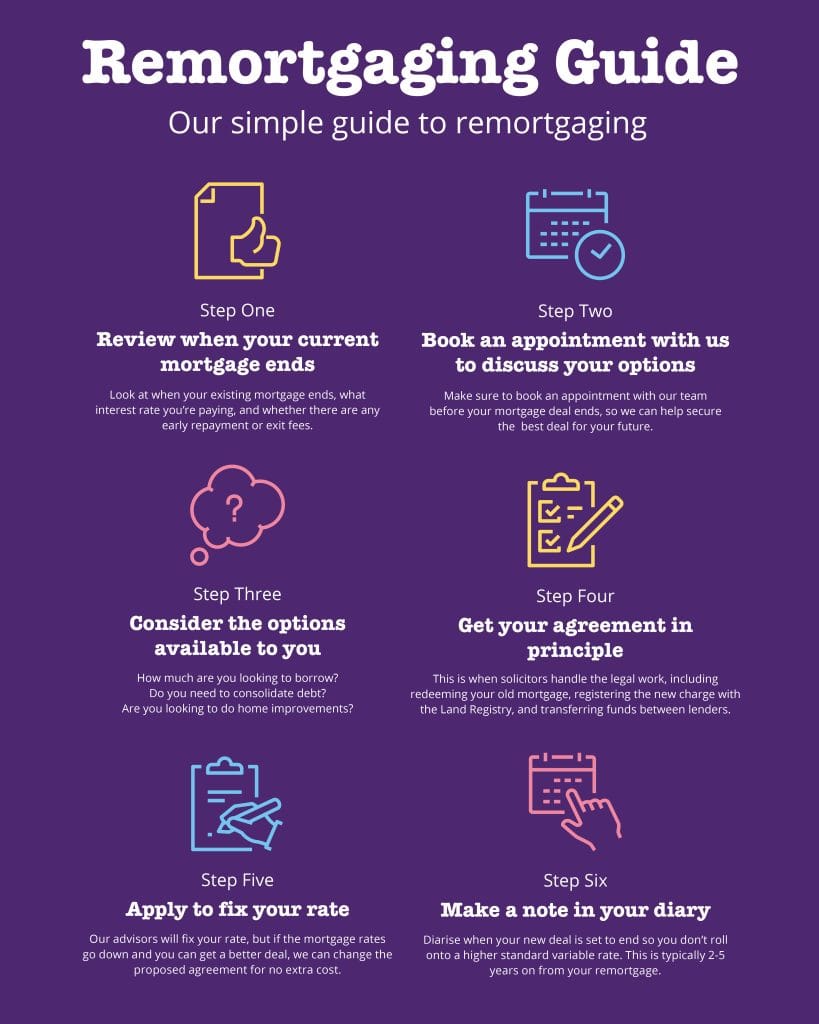

Here at Sirius Financial, we’ve put together a handy six step guide to re-mortgaging your property and it’s designed to help those who are approaching the end of their existing mortgage deals. One of the most important things to bear in mind is that re-mortgaging isn’t about selling your house and buying a new one, it’s about getting a better deal with better rates that gives you increased financial flexibility.

Step one

Where do you currently stand? That’s the very first question to ask yourself. When does your current mortgage deal end and what sort of interest rate are you paying. Bear in mind the interest rate you’re paying now will probably change when the deal expires and if it’s higher, then now’s the perfect time to start a conversation with us at Sirius Financial, because we have ‘whole market’ access to a broad spectrum of better deals.

Step two

The next logical step is to get an appointment booked in with one of our highly experienced, professional mortgage advisors. What’s important at this stage is to get that appointment booked in before your current deal expires. This will make everything easier and smoother and will undoubtedly give you more options.

Step three

Once the appointment is booked in, it’s time to start seriously thinking about what you actually want. Mortgages are a great way of reviewing all of your personal finances as it’s the single biggest borrowing that most people undertake. How much do you want to borrow? Do you want to consolidate other debt which is currently at a much higher rate? Are you looking at home improvements? These are all key questions to ask yourself now while you have the opportunity to find a better, less expensive option.

Step four

Now’s the time to start getting your agreement in principle and this is where your legal representatives start carrying out work such as redeeming your old mortgage, registering your new charge and transferring funds between your new and old lender. It never really requires much effort, from you, the applicant, but it is the sort of detail that needs to be handled by a professional. Don’t worry, we can always recommend solicitors that we know and trust to get all of this done properly.

Step five

The next stage is to get your new deal fixed, as this creates peace of mind where you know exactly how much you’ll be paying on a monthly basis, regardless of what the Bank of England does with interest rates. But remember, if a better deal comes along, we can always adjust again at no extra cost.

Step six

Lastly, put a note in your diary for when your new rate is set to end, to start this process again and avoid being put onto a higher standard variable rate. This will typically be 2-5 years after your remortgage, and again we’ll ensure that you get the very best rates available.

Here at Sirius Financial we specialise in helping you find the right mortgage product. We not only pride ourselves on being both approachable and professional but we also operate with genuine empathy and understanding. Changing mortgages can often be tricky, but not with Sirius Financial by your side.